Digital Launch

It is never to late to start with your digital journey. We at TCE, have a team of experts who will be more than happy to bring your business online.

Being digitally present is not enough constant digital growth is also important. We provide the best solutions for such growth. Get in touch with us to let us help you with your growth!

Driving influence for leading brands!

Digital strategies are an essential part of every company. Our team at TCE focuses on creating strategies unique to each of our clients.

We at TCE can help you with the Social media as an opportunity to engage & converse with your customers about your product and services.

We at TCE have a massive network of influencers who can help your brand reach the right audience and deliver your message to the extreme edge of the social media network

Witness with us, the world of the greatest content produced with the team of production experts at TCE. We can produce content for tailored for your requirements

Unlock the full potential of influencer marketing with TCE, the Global Largest MCN & KOL Marketing Company. At TCE, we lead the way in bridging the gap between influencers and brands, driven by a commitment to ROI and fueled by intelligence. Our journey began in 2014 as a Software Developing company, and today, we stand at the forefront of the digital media marketing world.

TCE has evolved into a powerhouse, boasting the title of the Global Largest MCN & KOL Marketing Company. Our vision is to seamlessly connect influencers with brands, creating dynamic partnerships that drive measurable results.

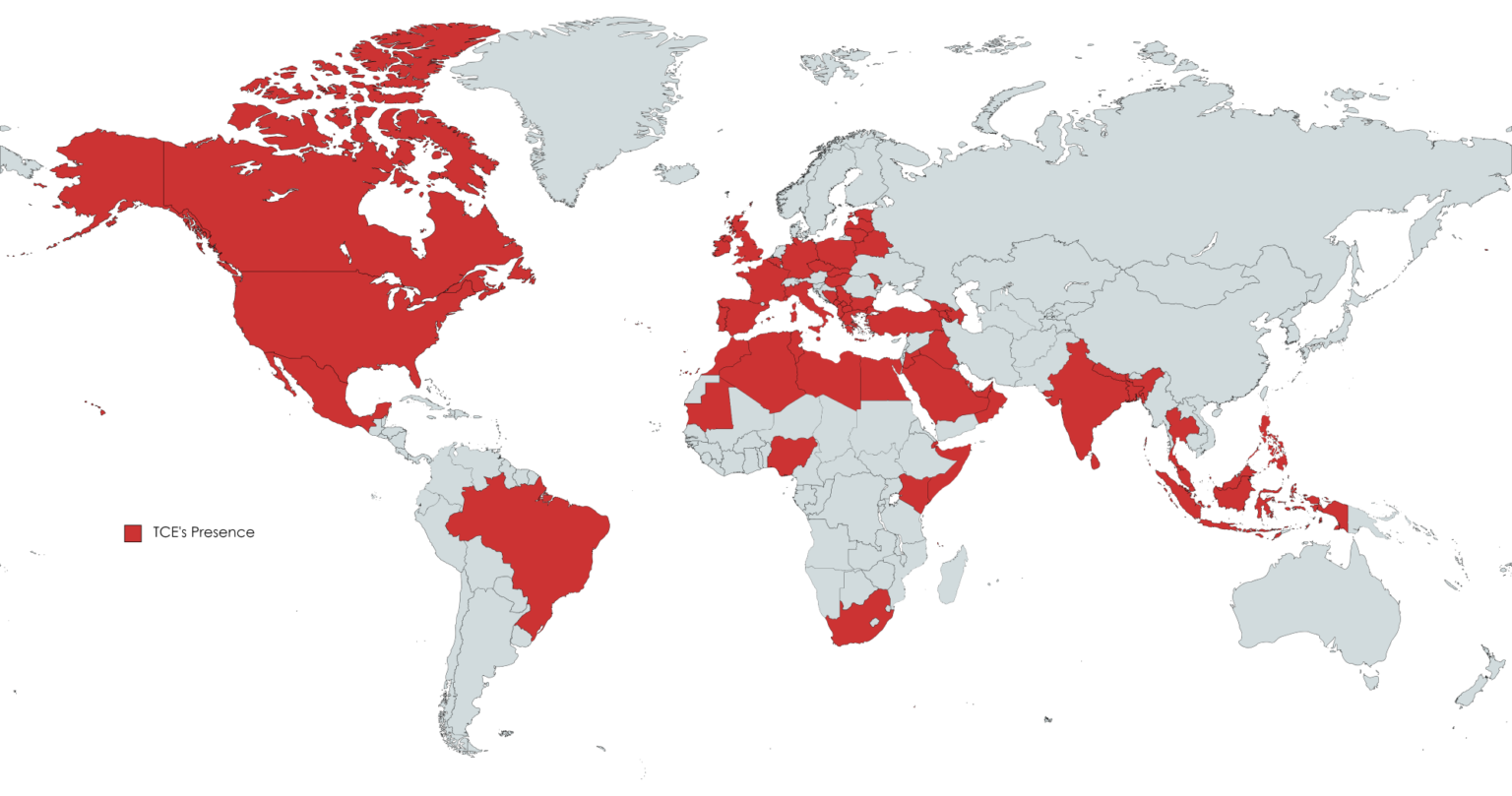

Spanning across ASIA, MENA, EUROPE & AMERICA, TCE has cultivated a community of over 1 million content creators and influencers. Our global reach ensures that your brand’s message resonates with diverse audiences, maximizing impact and engagement.

With a track record of executing 500+ successful campaigns, TCE delivers results that matter. Each campaign is meticulously crafted by our expert team, ensuring that your brand story is told authentically and effectively.

As we continue to grow, TCE remains dedicated to pushing boundaries and developing innovative solutions for the digital media marketing landscape. Our commitment extends beyond campaigns; we aim to be your strategic partner, driving your brand towards unprecedented success.

MENA

Europe

APAC

America

We believe not all brands are same, so no solution is perfect. Hence, our solutions are not limited to one set of services and grows infinitely with your digital growth.

We work with top of the niche creators from various countries across the globe.

We believe Being Digital is not just about existing Digitally but growing with the digital era.

TCE provides end to end digital solution. We provide the best service you will ever require to build your digital growth. No brand is too big or too small for us, we believe the digital era has the infinite opportunities for everyone. We at TCE make sure that every business and every brand makes infinite benefits out of it. Our vision is majorly aimed to provide with the 4 core digital service:

Digital Launch

It is never to late to start with your digital journey. We at TCE, have a team of experts who will be more than happy to bring your business online.

Digital Growth

We aim to provide the best solutions for the business to grow digitally. There's always more to earn in this digital world and TCE will help you to leverage the maximum.

Digital Analysis

We provide an end to end analysis of your digital presence, trend associated with your brand image and the potential opportunities you can leverage from the ongoing or upcoming trends.

Digital Production

Content is the king in this digital era. We at TCE have a team of in-house production experts who can produce and release new and relevant content for your digital growth.

There’s no great step than getting started! Get in touch with us now to grow your digital strength.

Please fill in the required details to let us serve you the best!

We at TCE, have a team expert to help you grow your business online and provide end-to-end solutions for your digital growth 🚀

Analyse your current presence. Analyse your Market. Identify potential opportunities

Study the audience. Prepare the strategy. Plan the Campaign.

Build the campaigns. Prepare the grounds. Launch the campaigns

TCE believes in growing together, hence we would be glad to help you in your project with our network of influencers. Click on the button below to enroll yourself with us!

📍 Kemp House 160 City Road

London

📧 [email protected]

📍2055 Limestone Rd STE 200-C, Wilmington 📧 [email protected]

📍 Al-Nahda Towers-Sharjah

📧 [email protected]

📍Samuel Street, Fort, Mumbai

📧 [email protected]

📍UNIT 1603, 16TH FLOOR, THE L. PLAZA 367-375 QUEEN'S ROAD CENTRAL SHEUNG WAN, Hong Kong, 999077

📧 [email protected]

Fill your email inbox with our great and upcoming news. Don’t worry! Even we hate spam